Solutions

Tax Reporting

Tax reporting is a complex and time-consuming task for many multinational companies. It involves calculating and analyzing current and deferred tax at national and regional levels, complying with global tax regulations, and aligning tax with corporate financial reporting.

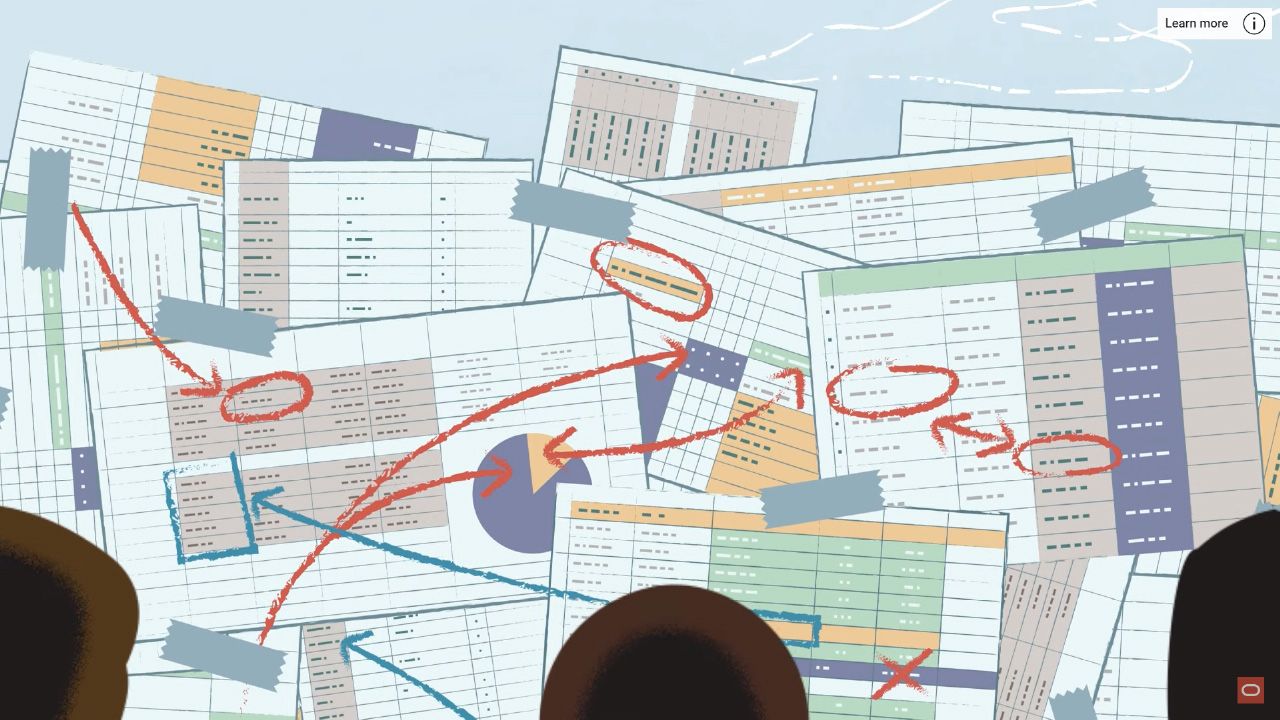

Using spreadsheets or legacy systems for tax reporting can lead to errors, inefficiencies, and lack of transparency. That's why Oracle offers a comprehensive solution for tax reporting that leverages the power of cloud-based enterprise performance management (EPM).

Oracle EPM Tax Reporting is a cloud application that provides best practices, out-of-the-box tax reporting for medium to large multinational companies. It includes features such as:

- Tax Provisioning: Calculate and report on current and deferred tax provision in accordance with accounting standards such as IFRS and US GAAP.

- Country by Country Reporting: Generate and submit country by country reports to meet the requirements of the OECD's Base Erosion and Profit Shifting (BEPS) initiative.

- Workflow Management: Manage and monitor the progress of tax processes across multiple entities, jurisdictions, and users with built-in workflows, approvals, and notifications.

- Supplemental Data Management: Collect and validate additional data for tax reporting purposes, such as transfer pricing, uncertain tax positions, R&D credit, and more.

- Dashboards and Key Performance Indicators: Visualize and analyze tax data with interactive dashboards and KPIs that provide insights into effective tax rates, cash taxes, tax risks, and tax planning opportunities.

Benefits of Oracle EPM Tax Reporting

Oracle EPM Tax Reporting offers several benefits for tax professionals and finance teams, such as:

- Seamless integration with Oracle EPM Financial Consolidation and Close and Oracle ERP Financials, enabling greater efficiency, accuracy, and transparency between book and tax reporting.

- Easy configuration and maintenance of tax processes with configuration wizards and cloud updates, reducing the need for IT support and customizations.

- Enhanced collaboration and communication among internal and external stakeholders, such as auditors, tax authorities, and regulators, with secure data access and audit trails.

- Improved compliance and risk management with automated validations, reconciliations, and controls, ensuring data quality and consistency across tax reports.

- Scalability and flexibility to adapt to changing business needs and tax regulations, with the ability to add new entities, jurisdictions, scenarios, and calculations.

How to Get Started with Oracle EPM Tax Reporting

If you are interested in learning more about Oracle EPM Tax Reporting or want to see a product demo, you can visit the Oracle website or contact an Oracle representative.

You can also access the Oracle Help Center for more information on how to use the application, including tutorials, videos, documentation, and FAQs.

To get a hands-on experience of Oracle EPM Tax Reporting, you can sign up for a free trial or request a live experience workshop.