Poor customer experience during the digital commerce payment process hampers sales conversion rates and leaves revenue on the table. Technology leaders can use this article to identify best practices that will improve the customer payment experience and optimize sales conversion rates.

Key aspects

Payment needs and preferences vary greatly from one customer group to another, yet the digital commerce payment process is often one-size-fits-all.

An ever-increasing share of digital commerce transactions are initiated from mobile devices, yet the customers’ experience with mobile payments is often overly complex and a deterrent to sales conversion.

Customers’ payment experience preferences continuously evolve, yet organizations struggle to keep up with those ever-changing wants and needs.

Many options exist to offer a streamlined payment process for digital commerce, but supporting too many can be expensive for your organization and overwhelming to customers.

Digital commerce payments

Personalized experiences have proven to improve sales conversion rates and reduce shopping cart abandonment. A review of more than 125 case studies found that when used at the right touchpoint’s personalization boosts engagement, decreases cart abandonment, and increases revenue (up to 28%) and conversion (up to 71%).

The payment process is the last mile of the customer’s overall purchase experience and the company’s online conversion opportunity, yet it is often overlooked or undeaddressed. Payment is often seen as an administrative task, and not seen as an opportunity for optimization. As a result, digital commerce businesses are leaving money on the table. Browsers who could become customers are instead disengaging due to cumbersome payment check-out experiences.

For digital commerce transactions, most of the customers’ payment experience is driven by the user experience during check-out and this article will focus on those aspects. However, it is important to also consider offline processes that may impact the payment experience. These will often be related to exception processes that could include, for example, payment data error correction, customer care in the event of a potential fraud issue or an offline return.

So how do application leaders ensure that your digital commerce business provides the most ideal and fluid payment process for your customers? See Figure 1 and follow the best practices in this article to create a payment experience that:

Adapts to a customer’s profile

Reduces unnecessary customer effort to create a more frictionless experience

Adapts continuously to changing customers and technology

Controls costs by leveraging the most impactful payment options

Key Components of Digital Commerce Payment Experience

Figure 1. Key Components of Digital Commerce Payment Experience

Personalize the Customer’s Payment Experience

Customer payment preferences vary greatly from one region or country to another. The dominant payment methods in any one geography are influenced by a myriad of factors including:

Culture — Differing attitudes toward everything from technology, the use of debt, likelihood to try before you buy, and more will impact what payment methods are popular in a particular geography.

Regulatory environment — With its local, regional and national regulations, the environment may create headwinds or tailwinds for different types of payments, accelerating or hindering adoption.

Economic climate — An economic downturn will affect buyer behaviors and payment choices differently from an economic boom.

Banking system — In addition to regulatory concerns, the size and structure of a banking system will affect the adoption of bank-based payment methods. For example, a country with a consolidated banking system with few banks or a region with an open banking environment will provide a more fertile ground for bank-based payment innovation than a country with a diverse banking environment distributed across hundreds of independent banks.

Availability of credit — Ease of attaining credit will impact consumer payment behavior and is most often tied to and influenced by all the factors listed above.

Influence of digital giants — Companies like Apple, Alibaba, WeChat that have huge installed user bases are often able to educate and influence those users, increasing or accelerating payment method adoption.

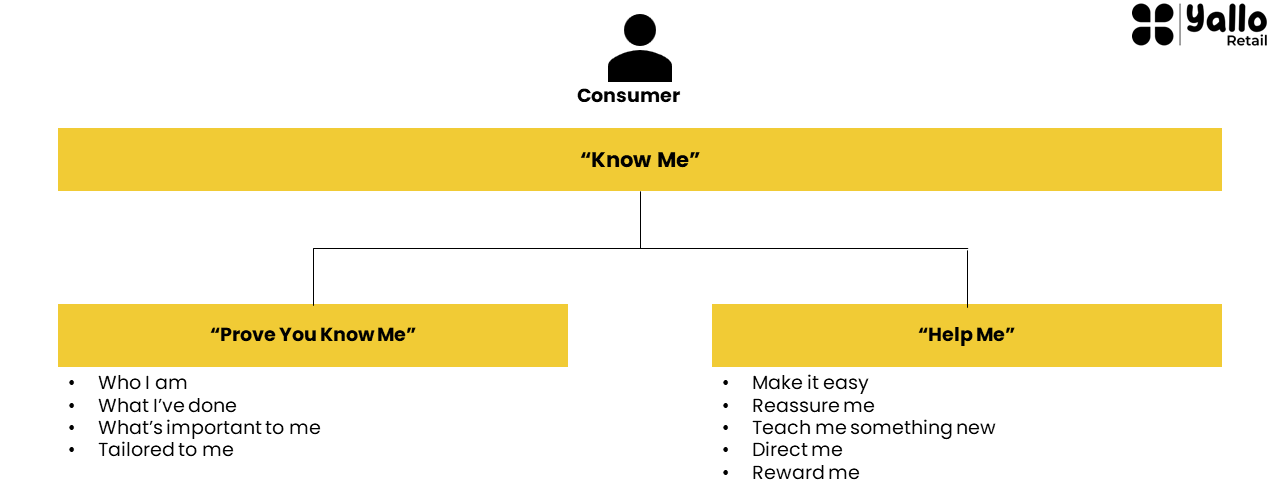

To optimize the customers’ experience, digital commerce application leaders need to adapt the entire commerce buying journey — including the payment transaction — to the unique preferences of the individual customer. An important distinction emerges here regarding two types of personalization of the customers’ experience of the payments process. It’s not “prove you know me” forms of personalization but “help me” forms of personalization that customers value:

Prove you know me. This is a demonstration by the brand that it knows something about the customer.

Help me. The brand makes it easier for the consumer to complete a task or get through a purchase.

Figure 2 illustrates this concept.

Consumer Perceptions of Personalized Messages

Figure 2. Consumer Perceptions of Personalized Messages

Notably, brands experienced a 16% lift in commercial benefit moving from bottom to top quartile performance on the help me category. But if a brand were to move from bottom to top quartile performance when it comes to the prove you know me category the same brand would experience a 4% drop in commercial benefit.

What does this mean for the personalization of payment user experiences? It means providing features along the check-out and payment process that will prove you know the customer, but more importantly can also help the customer. These features designed to help customers could include:

Adaptive web design for payment pages using a combination of the adaptive web server and the browser-based responsive design

Localization for language, including payment nuance and popular payment methods

Personalization for stored payment methods or previously used payment methods

Options for auto population of billing and shipping address, and contact information

Many digital commerce payment vendors offer hosted payment pages that inherently include these adaptability features and that allow for the addition or deletion of functionality or methods of payment via simple configuration, rather than development or customization. Hosted payment pages that involve redirecting the consumer to a separate payment webpage often add an additional step in the payment process and can confuse and frustrate customers and erode trust. Avoid this redirect by embedding the hosted payment page or fields in the merchant’s check-out page by using the vendor’s API or web UI libraries to support vendor-hosted payment fields.

Provide a Low-Effort Payment

Process Providing low-effort or frictionless experiences to your customers has significant benefits including higher repurchase rates and spending, as well as reduced disloyalty and negative word of mouth. 2 Simple, streamlined payment processes with minimal distractions throughout the steps of the check-out process optimize conversion rates and increase customer satisfaction. However, most commerce user experiences continue to require text-heavy navigation and multiple steps to pay for a purchase, resulting in lost sales and decreased customer satisfaction. This is especially true for mobile check-out processes.

Providing a low-effort payment process, especially on a mobile device, is largely tied to reducing the overall number of keystrokes required. However, other elements such as field size, layout/format and one page vs. two also affect the user experience and the amount of effort required to complete the payment process. It is also possible that too few keystrokes can be equally displeasing to a customer — for example, if the customer completes payment for an order without realizing it. Including a final confirmation step is recommended before processing payment, even if this adds keystrokes.

Amazon pioneered frictionless check-out with its one-click check-out, the patent of which expired in September 2017. The dominance and genius of Amazon’s customer-centric design has set user expectations for ease of customer check-out. One-click check-out is such a critical component of a frictionless commerce experience that the World Wide Web Consortium (W3C) is working on a standard that would support a one-click payment through any site via credentials stored on their browser. PayPal reports that its One Touch increased conversion by 60%.

Another best practice that is often missed is allowing customers to complete the sale without forcing them to register. As desirable as customer registration data may be, it is rarely more valuable than completing the sale and making them a customer. Customers often become frustrated when they are forced to create an account with a merchant to complete the check-out process. A more customer-centric approach includes:

Encouraging your new customers to pay as a guest and then to save their information once it’s entered in for the sale.

Offering a simple toggle button that allows them to save or not save this information for future use.

Changing the default selection to “yes” to encourage participation. The customer will still need to create a password and can therefore change their mind at the next step if they overlooked the preselected option.

Recognize that if the customer selects a third-party wallet as a payment method, such as PayPal, Klarna or WeChat Pay, then you may not have access to storable payment data anyway. Rigidly enforcing customers to register is a deterrent to conversion.

Another dated practice that is still commonly used on many websites is asking the customer to input the card brand (i.e., Visa, Mastercard, American Express). Although it may be tempting to believe that this extra data element will improve data integrity, it is not the case. The card brand can be easily determined by the card number and only a very unsophisticated fraudster would not know this. For example, Visa cards typically begin with a 4, Mastercard with a 5, and American Express with a 3. Asking your customer to check the appropriate box adds effort and an unnecessary keystroke that can easily be eliminated.

An ever-increasing share of commerce transactions is being conducted via mobile devices. As a result, utilizing the tactics described here to make the payments process low-effort is particularly important for improving the experience of mobile commerce. In the U.S., smartphone transactions accounted for 31.8% of online retail sales in 3Q18, up from 27.8% in 2017. In China, 84% of consumers were using mobile phones to shop in 2017, up from 81% in 2016. Make the most of these mobile opportunities by optimizing the users’ payment experience.

Finally, remember to maintain a healthy balance between your fraud controls and your customer experience. Attempts to corroborate customer identity using legacy tools such as knowledge-based verification, CAPTCHA or one-time passwords frequently result in customer frustration and abandonment of an enrollment, login or purchase. Preventing fraud is critical to the bottom line, so implement more passive authentication tools where possible to minimize customer effort while maintaining or improving fraud detection.

Measure the Payment Experience

Many organizations are already measuring the payment process financial and operational components, like shopping cart abandonment, conversion rate and merchandise value transacted. In addition to the financial and operational performance of your payments, it is also important to measure the customer experience of the payment process. Examples of payment’s CX metrics include abandonment rate on payments page, number of clicks to complete process, time taken to complete payment process, frequency of data reentry or reselection that may indicate errors due to nonintuitive user experience.

The following are a few suggestions on how to do this:

Send a brief survey to the customer after the transaction is complete. For instance, it could be via email, or embedded in your organization’s mobile app — asking about their satisfaction with the check-out and payments experience. Use metrics like the Customer Satisfaction Score (CSAT), Customer Effort Score (CES). Include questions that specifically address the payment experience.

Analyze behavioral metrics to find more evidence for how customers are responding to your payment process.

Assign an owner to the payments’ customer experience metrics. Although this may be the same individual who owns the payments’ financial and operational metrics, the important part is building accountability for the payments’ customer experience.

Set goals for payments’ customer experience metrics once they are stable and their accuracy established. Link employee compensation to them as well. Do this in conjunction with the financial and operational metrics of the payments experience.

Add metrics describing the payments experience — financial, operational, and customer experience — to your customer experience metrics dashboard. This will help you better identify interrelationships between these metrics and other customer experience ones. Dissatisfaction or satisfaction with upstream components of the customer experience may influence the downstream shopping cart and payments, while the customer’s experience of the payments process can affect the customer’s overall impression of the organization.

Control Costs

The experience is always best for any customer when they can pay the way that they prefer to pay. However, adding any new functionality is beholden to diminishing returns: Beyond a core set of valued payment methods, additional ones will not result in any material customer satisfaction or conversion increases. In fact, it may negatively impact the customer experience and/or conversion rate if the check-out process becomes cluttered. Although having many available options may be beneficial for the experience of making a payment, each additional payment method incurs expenses. As such, a balance needs to be struck between adding more choice for the customer in terms of the number of payment methods supported and the related costs of adding choice.

Unique operational, finance, customer support, technical and other requirements may exist for each individual payment method. Different types of businesses will realize different returns from deploying any of the large number of lower-use alternative payment methods for that region or country. For example, digital streaming and video games businesses often have high margins and unlimited scalability, resulting in little hard cost for fraud losses and a strategy that is defined by converting as many sales as possible, no matter what. In this environment, it is common to see a diverse collection of payment options, supporting any possible way a customer would like to pay. It is also a high-repeat-use business and gamers using the platform are likely to be more tolerant of sorting through myriad payment options to find their preferred way to pay, at least initially. After that, ideally the platform recognizes the customer and remembers previous payment transactions; it then places the applicable options in the most accessible position.

Conversely, a hard goods retailer that gets many one-time purchasers may find that cluttering the payment page with too many options is neither good for the user experience, nor do many payment options get any material use. In this case, managing the contracts and costs, plus operational reconciliation and support processes — including development maintenance and performance monitoring — will likely erode any lift in sales and will not produce a positive ROI for the company.

If customers request that you support a specific payment method, then train your support staff to gather more insight into why the customer is asking for it. Although the customer may have an affinity for a particular wallet and routinely store funds there or use it as a matter of preference, that is not always the case. Sometimes customers request a certain payment method because they want an experience that they associate with that payment method. For example, if the customer desires a one-click check-out and you have loyal repeat customers, then creating a closed-loop wallet with stored payment credentials and integrated loyalty rewards may better meet the demand than adding the named payment method.

Application leaders should also keep abreast of what’s happening in the payments market and explore trends that are gaining rapid adoption. For example, it is estimated that by 2024, 15% of global B2C digital commerce transactions will be funded using a deferred or instalment plan payment method. 6 This adoption will vary by region and be impacted by economic and cultural factors. Being aware of changes in consumer preferences that are trending quickly toward adoption can help digital commerce companies plan ahead and be prepared before it becomes a competitive disadvantage.

We recommend that you perform a holistic analysis of all these aspects before deciding to add support for an emerging or fringe payment method.