Solutions

Navigate the Financial Landscape with Confidence - Unveiling Oracle EPM

In today's dynamic business environment, financial transparency and data-driven decision-making are crucial for navigating complexity and achieving sustainable growth. Enter Oracle EPM, a cloud-based Enterprise Performance Management (EPM) suite designed to empower organizations of all sizes with a comprehensive set of tools and functionalities. This article delves into the intricacies of Oracle EPM, exploring its core functionalities, benefits, and how it can transform your financial management strategies.

Leading Tools and Platforms for Optimized Financial Management:

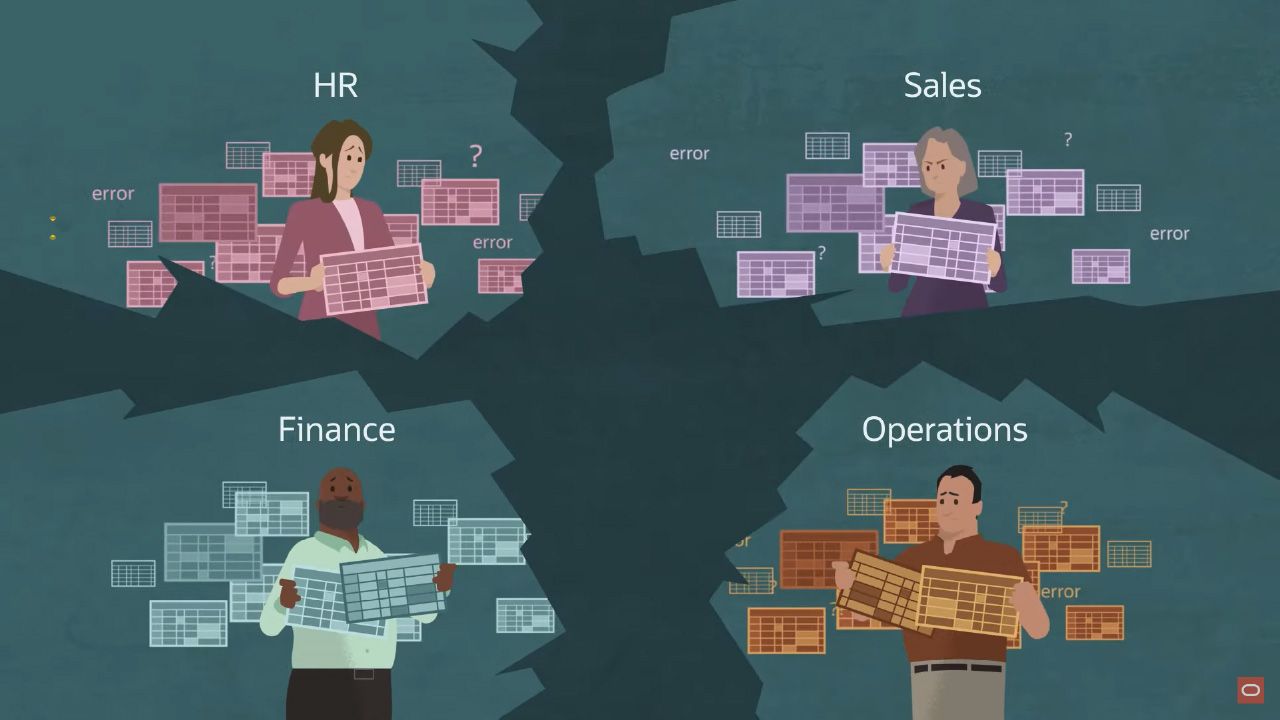

EPM Platform: Imagine a unified hub for all your financial management needs. The EPM Platform provides the foundation, seamlessly integrating various EPM applications and ensuring consistent, reliable data across your entire financial ecosystem. Think of it as the conductor of your financial orchestra, ensuring all instruments play in harmony. Read more

Planning & Budgeting: Ditch the static spreadsheets and manual calculations. Planning & Budgeting empowers collaborative forecasting, scenario modeling, and real-time performance tracking. Think of it as your crystal ball, helping you anticipate future financial landscapes and make data-driven decisions for sustainable growth. Read more

Profitability & Cost Management: Uncover hidden cost drivers and optimize profitability like never before. This tool empowers you to analyze profitability by product, segment, or any other dimension, pinpointing areas for improvement and allocating resources effectively. Think of it as your financial microscope, revealing hidden opportunities to maximize your bottom line. Read more

Financial Consolidation & Close: Eliminate the stress of month-end closing with automated consolidation processes. Reduce risks, ensure accuracy, and improve timeliness with streamlined workflows and centralized reporting. Think of it as your financial pressure cooker, condensing complex tasks into efficient and reliable processes. Read more

Account Reconciliation: Reconcile accounts faster and with fewer errors. Leverage automated tasks, exception management, and real-time visibility to ensure timely and accurate financial statements. Think of it as your financial detective, meticulously ensuring every penny is accounted for. Read more

Tax Reporting: Simplify the complexities of tax compliance. Automate calculations, generate accurate and compliant reports, and streamline tax management processes. Think of it as your tax wizard, navigating the intricacies of regulations and saving you valuable time and resources. Read more

Narrative Reporting: Craft compelling stories with your financial data. Create visually appealing reports with embedded charts and data visualizations, effectively communicating financial performance to stakeholders. Think of it as your financial storyteller, transforming dry numbers into captivating narratives that resonate with your audience. Read more

Freeform: Design custom reports and dashboards tailored to your unique needs. Dive deeper into specific areas of your financial data and gain actionable insights beyond standard reports. Think of it as your financial explorer, venturing beyond the mapped paths to discover hidden treasures of information. Read more

Enterprise Data Management: Ensure the foundation of your financial decisions is solid and reliable. Enterprise Data Management guarantees data quality, consistency, and integrity across your entire financial ecosystem. Think of it as your data guardian, ensuring the information you rely on is accurate, trustworthy, and ready to empower informed decision-making. Read more

By harnessing the power of these integrated tools within Oracle EPM, you can transform your financial management, gain complete control over your financial data, and make confident decisions that propel your business towards sustainable growth and success.

What is Oracle EPM and Why Choose It?

Oracle EPM is a unified platform encompassing various aspects of financial performance management, from budgeting and forecasting to profitability analysis and regulatory reporting. It offers a centralized solution for streamlining financial processes, gaining real-time insights into your business, and making informed decisions that drive success.

Why choose Oracle EPM?

- Enhanced Financial Visibility and Control: Gain real-time insights into your financial performance with centralized data, automated reporting, and interactive dashboards.

- Improved Planning and Budgeting: Streamline budgeting and forecasting processes, enhance collaboration across departments, and make data-driven decisions for the future.

- Cost Optimization and Profitability Analysis: Identify cost drivers, analyze profitability by product or segment, and make informed decisions to maximize financial performance.

- Simplified Compliance and Reporting: Automate financial consolidation, streamline regulatory reporting, and ensure adherence to accounting standards.

- Scalability and Flexibility: Adapt to your evolving business needs with a scalable cloud platform that accommodates growth and changing reporting requirements.

How Does Oracle EPM Work?

Oracle EPM operates on a secure cloud platform, facilitating accessibility, collaboration, and real-time data updates across your organization. It leverages pre-built, industry-specific applications that can be customized to cater to your unique financial processes and reporting requirements.

Conclusion:

Oracle EPM is more than just an EPM solution; it's a strategic investment in your organization's financial health and future success. By streamlining processes, fostering data-driven decisions, and providing actionable insights, it empowers you to navigate financial complexities with confidence, optimize performance, and achieve sustainable growth.

Ready to Gain Control of Your Financial Future?

Visit the Oracle website or contact an authorized partner to learn more about how Oracle EPM can transform your financial management strategies and empower you to achieve your business goals.